In the last six months, researchers in consumer industry has focused on the consuming behavior of post-00s. As far as I am concerned, it is appropriately to discuss this topic, but I don’t think it is necessary to study it too deep.

First of all, given that the fact shows that most of the post-00s still have not have their own disposable income, researchers do not have enough useful samples to do the study.

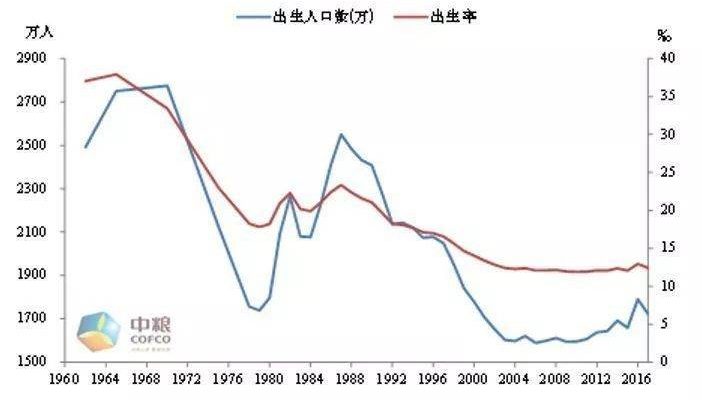

Secondly, the population of post-00s is not as large as many people estimated before. According to the data of the National Bureau of Statistics, since the reform and opening up, China’s birth population has reached the peak around 1988, and still grew by around 20 million every year in the next decade. But since 1998, the birth population has declined considerably.

Therefore, there is no need for consumer goods companies to spend too much time on the study of post-00s. Note these figures: the population of the whole post-90s is 190 million (another version is 188 million), while the whole post-00s is about 140 million. Not to mention, a certain group of them are classified as CHILDREN.

To be specific, for the companies who want to make profit from the youngsters, it is important to target the elder post-90s, namely, people born between 1990 and 1995, or the ones who have been working for about five years.

A generation that cannot be labeled

When it comes to the consuming behaviors of the post-90s, I have to say that currently the entire consumer goods market is full of misunderstanding. The reason for this situation is partly because the decision-making people do not quite know about youngsters.

Born in 1950s and 1960s, these older managers’ notion of consumption is quite different from the people who born 1990s. So to speak, there is a certain tangible generation gap between these two kinds of people.

A more striking fact is that these older people not only don’t know about young people, they even do not quite understanding the daily life of ordinary people. The exquisite life of theirs has become a barrier that prevent them from knowing the truth and reality.

In addition, the social public opinion also played an essential role as misjudging post-90s people.

In the past 7 or 8 years, people have been used to labeling younger generation as some simple and negative words, which led companies misread this group of people’s attitude towards consumption.

In my opinion, as a generation, the post-90s has no common label. They are normal, ordinary human beings, with desires and feelings,love, fear, greed, laziness and dreams.

To make this clear, let’s turn back to the 1990s.

When the wheel of history entering into the last decade of the 20th century, China has gone through the first stage of reform and opening up and about to take off at full speed.

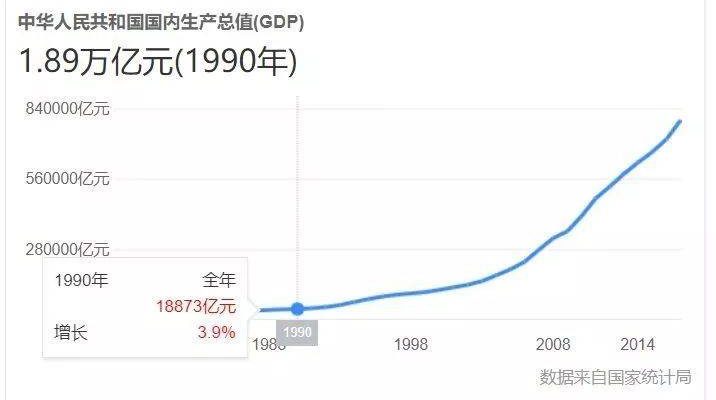

In 1990, China’s GDP per capita was only $344, (the RMB was about 1:4.7per dollar at that time) and the corresponding local currency was 1644 yuan a year.

In 1995, the local currency was 5,046 yuan, corresponding to US $604.

In 1999, the local currency was 7,159 yuan, corresponding to US $865.

So what does this set of numbers mean?

It means that being born in a different time period in the 1990s is much like being born in different economic entities. Individually speaking, these changes could be reflected in different characters, values, as well as the consumption concepts.

In 1990s, the average annual growth in Europe was 2%, while in China, the growth rate was always between 10% and 14%. In other words, One year in China is equivalent to five to seven years in Europe.

1992, China’s urbanization level was 27.63%. The urbanization of coastal areas has just begun, while most of inland areas has not yet started. Thus, even without considering the differences between urban and rural fertility rates, it was clear that more than 70% of the newborns were born in rural areas.

Therefore, it is impossible to give a uniform label to define the post-90s generation people. They were born in a fast-changing era, their parents’ lives changed fast, and their hometown was changing fast.

Some of them are descendants of workers, some are descendants of businesspeople; some people grows in coastal area, while some in some inland cities. For some of them, it is not until they were admitted in universities did they see the tall buildings of the provincial capital. The growth environments and personal experiences were so diversified and complicated that nobody can draw any common word to label this generation.

Common traits: partial rich

Varied characteristics as they have, there being some common traits shared by many post-90s generation people. In this paragraph, we will focus on these interesting commonalities.

Note: the source of statistics we applied in this article come from The Report on Consumption Behavior of Newcomers of Society, written by Vipshop and Nanfang Metropolis Daily. In this report, the newcomers of society are defined as the post-90s aged from 20 to 29 year old, and just graduated from universities within five years. That is to say, the consumer groups discussed in this paper are mainly those born between 1990 and 1995.

The first characteristic of consumption habits shared by many post-90s people is, they don’t mind to make big-ticket expenditures to buy the things they really like. More than half of the post-90s newcomers said that they don’t hesitate when buying big-brand clothing and high-end skin care products even if they know that their income is just at moderate level.

There is a word for it: partial rich. It is about people who would like to spend lots of money on some certain areas. Some people, for example, love headphones so much that they could spend most of their disposable income on them. This phenomenon is particularly prominent among the post-1995 generation.

So what is the implications for the brands? That is, average disposable income may not be an significant reference for the decision-makers in many industries. As consumers like your brand, they would spare no effort to buy the products. If don’t have enough cash, they even would buy it with cash loans.

Conversely, if don’t like the brand, they won’t spend a dim to buy it even they have enough spare money.

Bottom line: companies should actively seek out die-hard fans and provide them with reasons to be die-hard. Let them achieve a sense of superiority by purchasing these goods.

Considered that they are just “partial rich”, not “fully rich”, in the areas that they don’t quite crazy for, most of post-90s people would be much thrifty. Additionally, as many people received higher education and highly symmetrical consumer information, and they are good at using various tools to compare prices and avoid “tricks” from merchants.

As survey data shows that nearly 90% of the post-1990 generation would buy goods after compared prices, and nearly 80 percent will participate in discount, seckill and other promotion activities.

Please take a note: there is no conflict between pursuing high cost performance and being a partial rich guy. Both two characteristics could be existed in one post-90s generation consumer.

Another characteristic of post-90s consumers is related to their social skills. Compared with the elder two generations, the post-90s generation’s ability to socialize offline has obviously “deteriorated”, whereas their ability to socialize online has significantly better.

This feeling comes from my personal experience. I heard many complains about post-90s people’s social skills. Some said that in some certain social scenes, post-90s do not know how to talk with other people properly and naturally. Some even claimed that post-90s’ capability to deal with strangers was equal to zero. And an interesting phenomenon is that many youngsters, who speak rudely online, tend to remain silent and coward when voicing their opinions in daily life.

The statistics shows that post-90s spend 1~3 hours a day on social apps, and more than 80% of them have their own social circles. Even if they don’t know each other, they still could be gathered under the power of similar interests and consumption preference. One call this kind of social relation as “intimate sister on the Internet” or simpler: “cloud friends”.

Though the influence of KOL (Key Opinion Leader) on post-90s is declining, it doesn’t mean that they won’t find some other alternatives. Nowadays, more and more female post-90s become fans of peripheral product about hit TV series. The products as jewelry, bags, shoes and skirts appeared in popular TV dramas have become many post-90s girls’ favorites.

As for the male post-90s, their favorites are peripheral products about animation. They not only like buying pajamas, house clothes, jackets about the cartoons for themselves, but also love to buy toys about animation IP they liked to their children. Big data shows that the sales volume of periphery products increased by 77.39% year-on-year in 2018. The largest number of orders for Marvel products comes from Chongqing, and citizens in Shanghai spent the most on Marvel. Young people in second-tier cities spent the most on Honor of Kings and Marvel merchandise in China.

Another consumption trend need to be noticed. According to The Insight into Consumption in the First Half of 2019, nowadays, post-90s generation people show strong interest in “domestic products”. Corresponding to this trend, domestic brands are rising again in unexpected ways.

Let me name a brand that is familiar to the post-80s and 90s generation, Li Ning. Just a few years ago, people were discussing the demise of Li Ning. But recently, it has returned to the public sight. I once asked some young people about the rise and fall of this brand, but to my surprise, most of them answered me as “Li Ning is always good, right?”

For the younger generation, Li Ning as a famous domestic sports brand, never falls. But for the elder people like me, they witnessed the whole story of Li Ning. The different experiences of two generations reflect the fact that when Li Ning was in its low periods, the post-90s were too young to know about it. And while these people growing up, that old brand just backed to their sight.

In fact, Li Ning is not the only domestic brand that has enjoy the second take-off.

For example, beauty and skin care brands like Xie Fuchun, Kong Fengchun and Maxam, all of which look a little old, account for more than 30% of the fans of the post-80s generation, which is much more than the number of fashionable international brands like Estee Lauder and Lancome.

Data also shows that in the ranking of the Most Popular Beauty and Skin Care of Brands of Social Newcomer, 7 of the Top 10 are Chinese brands, including Mask Family, Unifon, Xiaomihu and One Leaf.

Based on a survey of nearly 3000 social newcomers’ consumptive attitudes, a report found that nearly 17% of young people trusted and used Chinese brands’ products, and nearly 50% spoke highly of domestic brands. In recent years, the sales volume and sales growth of post-90s purchasing national commodities are far more than those of post-80s and post-70s.

Diversified post-90s

After analyzed the commonalities, we take a look at the diversities of post-90s generation.

First of all, in terms of issues of love and marriage, post-90s young people have varied views. 45.67 percent of post-90s social newcomers hope to “have a happy family and have children”; 22.73% choose to “down shifting”, meaning to go with the flow and not take too much efforts on finding the right person. Additionally, over 30% people said they enjoyed being single and craving for love while not want to get married.

Secondly, we talk about behavior of purchasing houses. Survey data shows that the purchase rate of post-90s households in lower-tier cities, including second, third, fourth and fifth, has exceeded 40%, while the number in first-tier cities is 29.91%.

But in terms of savings, the picture is quite different. More than 15% of the post-90s generation in first-tier cities have deposits of more than 100,000 yuan, while in third-tier cities the number is less than 10%.

However, according to data provided by Tencent Social Advertising, the average savings of the post-90s generation are only over 800 yuan, much less than that of the post-00s generation.

In this sense, it is essential to notice the fact that with roughly 190 million post-90s people in China, so large population in size, researchers could easily deviated to the wrong direction by the average number and lose their grasp for the wholeness.

Consumptive behaviours

After discussing the characteristics of consumption of post-90s generation, we now go into their concrete consumptive behaviors.

Big data shows that the sales volume of beauty apparatus started to explode in 2017, and in 2018, the sales growth of beauty devices in six-tier cities ranked first. The Top 5 sales of health care products are mainly nutritional supplements and weight loss products. Among them, medicine for tonifying kidney and regulating the menstrual cycle and acne medications are most popular.

In the past three years, sales of tight-fitting, fitness equipment, sports shoes and protein powders have maintained double-digit growth among users born in the 1990s. However, it does not mean that they actually spend a lot of time to exercise.

Compared with the post-70 and post-80 generations, the consumption of decorative objects such as cups and saucers, vases and tablecloths increased rapidly in the post-90s people. It seems that the values of to pursuit of small happiness and small beauty has been spreading rapidly.

Currently, the growth rate of purchasing kitchen utensils and small household appliances in the post-90s community has exceeded post-80s and post-70s, ranking first.

What’s more, sales of sweeping robots soared in 2018, with first-tier cities growing at nearly 166% and fifth-tier and sixth-tier cities at around 50%。Other products with fast growth in sales include intelligent speakers, bread makers and juice extractors.

The post-90s generation is a new generation of savvy consumers. On the one hand, they are not afraid to buy big brands, while on the other hand, they are much sensitive to the prices when purchasing daily necessities. With the growth of these burgeoning “new consumers”, the special sale mode is also rising rapidly.