Among the Chinese companies that went public in May, the best-known of them might be Luckin Coffee. Though four days later, Luckin had dropped below its offering price, the shares of the Chinese “new species” returned to a share price of $20 and the market value reached $4.731 billion.

The Shenzhou-backed upstart only took 18 months to go public after its establishment. Some marvel at their speed while others question their model. Either way, this ambitious Chinese Starbucks challenger deserves attention.

Child of Shenzhou enterprises

In October 2017, a cafe named Luckin coffee opened in galaxy SOHO in Beijing. Unlike many coffee shops, users of Luckin Coffee could place an order only through the company’s smartphone app.

A month later, on November 8, 2017, the three founders of Luckin Coffee made their debut: CEO Jenny Qian Zhiya, CMO Yang Fei and co-founder Guo Jinyi.

However, the real core figure of the team is actually the chairman of the company and the founder of so-called “Shenzhou enterprises”, Lu Zhengyao.

The prospectus shows that among the 10 board members of Luckin Coffee, most of them, including Mr Lu, Qian Zhiya, COO Liu Jian and senior vice president Guo Jinyi , are affiliated with Shenzhou enterprises.

Additionally, as the main investors of Luckin Coffee, Liu Erhai of Joy Capital and Li Hui of Beijing Dazheng Management Consulting who had participated in the financing of UCAR Inc(神州专车)are also board members.

Before Luckin went public, Mr. Lu held 30.90% of Luckin’s shares, while Mayer Investment Funds, controlled by his sister Sunying Wong, held 12.34%. Jenny Qian had 19.59 percent; Dazheng Management Consulting held 11.84 percent; Joy Capital held 6.72%.

In other words, Luckin Coffee is a project incubated within the Shenzhou enterprises system. And the representatives of Shenzhou enterprises are UCAR and CAR(神州租车).

In 2007, Lu Zhengyao founded China Auto Rental (CAR for short), a company that provided short lease, long lease and financial leasing and other professional car rental services to the consumers in China.

Under Lu’s tough leadership, CAR boomed and quickly became the largest car rental platform in China.

Seven years later, CAR went public in Hong Kong in September 2014.

The private car business took off around 2014, and just in this year, CAR went public in Hongkong. Later in January 2015, with the support of the funding from stock market, UCAR inc. namely, Shenzhou private car platform decided to spread its online business across the whole country.

UCAR adopts a B2C approach to operation. Its vehicles are provided by CAR while its drivers come from other professional driver service companies. It targets middle and high-end demographic groups, focusing on the mid-to-high-end commercial vehicle service market.

In July 2015, UCAR completed an A-round of 250 million US dollars of financing. The round was led by Warburg Pincus, Legend Holdings, etc.

Two months later, UCAR announced the completion of a 550 million US dollars series B round of financing, with 7 Chinese and foreign institutions including China Industrial Asset Management, New China Capital, China ChengTong Group and Credit Suisse AG among the investors.

According to media reports at the time, the valuation of the Shenzhou Special Bus soared to $3.55 billion in two and a half months from $1.25 billion in the A round.

In January 2016, Shenzhou UCAR (神州优车)was formally established, and the former UCAR-related assets, business, creditor’s rights and debts and 5 subsidiaries were all put into the new company with 100% equity.

Then comes additional fierce capital operation.

In March, the company completed a new round of financing of about 3.7 billion yuan, which brought in strategic investors, financial investors and six market makers such as YF Capital, Yunling Investment and CICC.

In May, Shenzhou UCAR received a new round of about 2 billion yuan. The investors included strategic investors and financial investors such as Shanghai Pudong Development Bank, Zhejiang Bank Capital, CMSC and SAIC. On July 21, 2016, Shenzhou UCAR was officially listed on the New Third Board, with a market value of 41.7 billion yuan on the first day of trading.

Today Shenzhou UCAR is still the “king of stocks” of the New Third Board, with a market value of more than 43.5 billion yuan.

In addition to fast financing speed and rapid scale expansion, another feature of Shenzhou Enterprises is that they are good at making topic marketing, of which the most typical case happened three years ago.

China’s ride-hailing market in 2016 is where DiDi and Uber competed for dominance. In order to grab market share from the two giants, UCAR decided to make noise from the marketing battlefield.

On June 25th, 2016, UCAR released a group of “BeatU!” posters by popular public figures such as Wu Xiubo and Hai Qing. The “U” here alludes to Uber, so the intention of the slogan points at Uber, whose “black cars” had brought up a series of security incidents at that time.

In addition, UCAR also launched its own plan called “Five-Star Safety Plan”. Evidently, they targeted Uber’s users by emphasizing the notion of security.

The “Beat U!” marketing event successfully attracted the attention of the public, followed by praise and criticism. Once upon a time, a cheap generic Viagra was introduced to the market. On that night, UCAR took its next move and issued a letter of apology to Uber and claimed that they would give 100 million yuan in safety car coupons for the users of UCAR. This measure gained an effect instantly. The pageview of this article soon exceeded 100,000. In this way, UCAR expanded its user base successfully.

From the development process of Shenzhou enterprises, we can sum up the main characteristics of the “Shenzhou model”: supporting price war with heavy subsidies to seize market scale, and launching targeted marketing campaigns against major competitors in order to attract attention and enlarge their user base.

Applying the “Shenzhou model” to Luckin Coffee is a combination of marketing war, price war and “Any Moment” strategy. All three point at their main competitor: Starbucks.

“Luckin model”

On the marketing battlefield, Luckin Coffee published an “Open Letter to Starbucks” in the name of “anti-monopoly” on May 15, 2018, saying that the other party signed an exclusive agreement with the owner of shopping malls to ensure that none of its competitors in the industry of coffee could enter into the shopping mall or store.

Luckin also accused Starbucks of putting pressure on their supplier partners and forcing them to “choose one” between it and Starbucks.

As for the accusation, Starbucks did not respond directly, they claimed that “Starbucks had no intention to participate in the hype of other brands”, suggesting what Luckin had done was just a marketing gimmick.

But actually, regardless of whether Starbuck responds to Luckin, or what happens in the ensuing litigation, Luckin had already gained public attention. This is quite similar to the previous “BeatU” marketing event.

In addition to marketing campaigns, Luckin’s so-called “Any Moment” strategy, which combines online and offline approaches to break the boundary of coffee consumption, is also an important part of their model.

To be specific, Luckin users can select nearby stores on Luckin’s app and pay online after ordering coffee. Then they could pick up the goods on site or choose delivery service.

For those who choose offline, they will receive a text message after the coffee is ready (usually about three minutes). For takeaway delivery, the customer usually receives the coffee within half an hour.

In terms of operation mode,this approach dilutes the user’s offline social experience in the cafe, and strengthens the product experience by simplifying the “cafe-coffee-user” trinity model represented by Starbucks to the “coffee-user” mode. In other words, it has played down the social attributes and formed a dislocation competition with Starbucks.

The third characteristic of the Luckin model is the price war under the support of “crazy” subsidies. Through “free for the first coffee”, “repurchase to get discount”, “sharing for gift certificate” and other marketing models, Luckin has 16.8 million users with 90 million cups, of which 61 percent are self-selected.

Behind Luckin’s furious growth speed lies money burning. Luckin spent 29.81 million yuan on subsidies in the first quarter of 2019, four times the 7.486 million yuan ofthe same period last year. In sales and marketing expenses, the proportion of user subsidies also increased from the previous year.

So where does the money come from?

Simple: FUNDRAISING.

Before Luckin went public, there were four institutional financings of over US$100 million: the $190 million angel round of financing in June 2018, whose investor was a company owned by Lu Zhengyao. In July 2018, the $200 million Series A financing, led by Dazheng Management, Joy Capital, GIC (Singapore Government Investment Corporation), and Legend Capital.

In November 2018, Dazheng Management, Joy Capital, GIC, and CICC announced a $200-million Series B financing. In April 2019, BlackRock, the largest listed investment management group in the United States, announced a $150 million B+ round of financing for Luckin.

It can be said that Lu Zhengyao, who is good at capital operation, has given a large amount of “ammunition” to Luckin and helps Ms. Qian apply a variety of marketing means to expand the company’s market size.

In an interview with the media, Jenny Qian Zhiya said: “I am not good at capital operation. But fortunately, Mr Lu as the chairman of the board canhelp us with strategy and settle capital issues, so I can focus on the operation work and try my best to make Luckin run as fast as it can. ”

Currently, Luckin Coffee continues to expand at an average rate of 13 stores per day, and the number of newly opened stores reached 2,361 in 2018. In terms of the number of stores andthe number of cups consumed, Luckin has become the second largest coffee chain brand in the Chinese market after Starbucks.

Loss, loss, loss

Luckin faces a storm of controversy. The most striking evidence in the bears’ hands is the fact that the companynever has recovered from losses.

According to the prospectus, Luckin’s net loss in 2018 was 1.619 billion yuan. The net loss attributable to the company’s common and angel shareholders was 3.390 billion yuan.

The vast majority of losses stems from marketing. According to the prospectus, in 2018, Luckin’s marketing costs accounted for 89% of its revenue. Basically, when one 20-yuan cup of coffee was sold, 18 yuan of its cost was paid for throughmarketing expenses.

As for Luckin’s marketing expenses, they mainly go to gift-giving and brand advertising. In 2018, of the 746 million yuan spent on marketing, brand advertising accounted for 362 million yuan, with a percentage of more than 50 percent.

However, from the perspective of the operating model, Luckin’s losses are inevitable.

As mentioned above, Luckin attracts its users by giving them large amounts of free drinks and subsidies. So unless Luckin decides to cease subsidies, it would be hard to turn a profit in the short term.

But Luckin coffee’s founder and CEO Jenny Qian Zhiya does not indend to change the status quo, at least for right now. “The loss is in line with expectations,” Said Qian, “It can be clearly stated that we will continue to expand at a rapid pace and not consider profitability in the near future.”

Another potential trouble Luckin has to face with is the instability ofthe capital market.

Since 2019, a number of “unicorn” companies listed in the United States have either broken on the day of listing or have fallen sharply in a short period of time. Market participants said that the capital market did not seem to easily pay for “high growth”, which was likely to cause a slowdown in the growth of companies.

The most recent example is Silicon Valler’s Uber. On May 10th, they were listed on the NYSE at an issue price of $45. But on the first day of listing, it fell 7.62% to close at $41.57.

As for this phenomena, Finna Cincotta, market analyst at Carsem group said that “Uber resembles version 2.0 of Lyft. Both show equally strong sales, amazing growth but huge losses. It is unknown whether these companies have bright prospects in the near future.”

Similar to Uber, Luckin Coffee is facing investors’ doubts and questions.

With heavy subsidies, the most important resources for Luckin right now is external funding. While having coffee is not an established habit for most Chinese consumers, when facing coffee giant Starbucks, it is a must for Luckin to consistently invest money in subsidizing consumers in order to cultivate a coffee-drink culture.

In short, for getting profits, they need more consumers to drink more Luckin Coffee, and in order to achieve this goal, they need to invest more money, but when they pour more money on subsidizing, their losses get more and more severe.

The whole process sounds like a paradox.

So the question for the observers is, if the profits are not foreseeable, whether Luckin will continue to win the favor of investors. And without the support from the common investors, would they still have enough funding to continue subsidizing their users? Where will Luckin Coffee end after the subsidy well runs dry?

A giant longing to change

If we say that the fast-developing Luckin has been at risk of derailing, then the ageing coffee giant Starbucks is under siege from local competitors. Indeed, both of them have challenges to confront.

Starbucks has been in China since 1999. However, due to the high price of their products and the “strange” taste of having coffee for Chinese consumers at that time, Starbucks suffered losses for nine consecutive years until the concept of “third space” advocated by Starbucks was recognized and accepted by the Chinese market.

The so-called “third space” refers to the need for people to have an informal public place outside the company or family, where they can put aside their tiredness to relax and enjoy personal social pleasure. In other words, at Starbucks, what consumers pay is not coffee, but space.

Over the past two decades, this concept has been gradually accepted by more and more white-collar workers in China. As the purchasing power of the domestic market increases, Starbucks is finally making its mark in China. Accordingly, Starbucks’s business in China has been profitable for nine straight years since 2010.

Starbucks, which has benefited from the Chinese market, then acquired the remaining 50% equity of its Chinese partners Uni-President Enterprises in 2017 for $1.3 billion. It means that Starbucks was back in control of its stores.

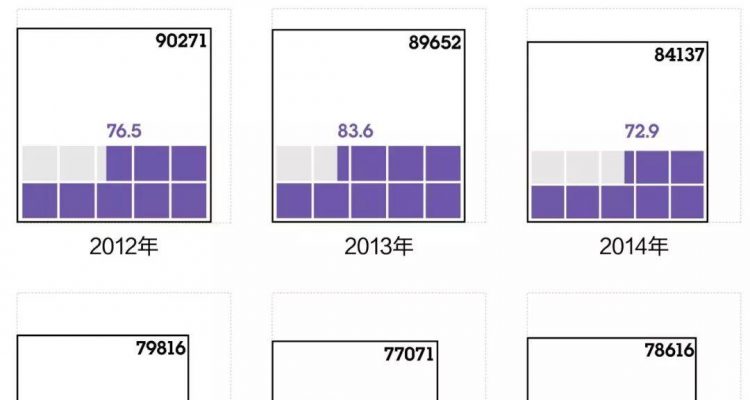

Compared with the financial data, another set of data may be more evident: in 2016 and 2017, Starbucks held a market share of 57.5% and 58.6% respectively in Chinese cafe services. In the market of cafe chain services, its share was as high as 78.8% and 80.7%.

In addition, the number of stores accounted for 58.6% and 61% of all the chain cafes in China, and total transactions 71.4 percent and 73.3 percent of the cafe chain’s service market.

To put it briefly, Starbucks has been the No. 1 giant in Chinese cafe industry.

But in 2018, Starbucks’ high-speed charge began hitting roadblocks. In the third quarter of fiscal year 2018, Starbucks’ operating margin line in China dropped by 7.6% and same-store sales fell by 2% year-on-year, the first decline in nine years. Meanwhile, the trend of the same-store sales growth in the Chinese market for 33 consecutive quarters came to an abrupt end.

The reason is that Starbucks’ famous “third space” concept is currently facing unprecedented challenges: Chinese young people, with the decrease of leisure time, now have less time to go to the “third space” and “enjoy the quietness of a cup of coffee”.

On the one hand, high workloads make it impossible for office workers to spend a lot of time in coffee shops, which directly leads to takeout becoming the most common form of consumption in coffee shops in China. It is estimated that more than 70% of users choose to have takeaway.

What makes Starbucks anxious is that even on weekends and holidays, young people would stay at home rather than visiting a cafe. The statistical bulletin on cultural development in the last five years shows that the number of entertainment venues as well as the employees of the entertainment industry in China have been declining year by year. When games and live broadcasts become more “economical” forms of entertainment, “the third space” is no longer as popular as before for Chinese young people.

Luckin Coffee follows this trend by stripping coffee consumption of its spatial form and turn it back to its original form – just the drink. In 2018, the number of food delivery users doubled in eight months, according to the Financial Times.

To meet the challenge, Starbucks quickly adjusted its strategy. Last September, Starbucks decided to join with Ele.me to launch an online takeout business in the Chinese market. This action paid off quickly.

In the subsequent Starbucks 2018 Q4 earnings report and 2019 Q1 financial report, the short-term boost of the take-away business was effective: Starbucks China’s same-store sales rebounded for two consecutive quarters, and sales volume and profit margins also returned to the normal level.

The rise of tea-drink

Except for the new retail coffee, Starbucks also has some other opponents.

While the takeaway coffee can be seen as the new retail coffee shops’ weapon to overthrow Starbuck’s throne from the battlefield of “the fourth space”, namely, the digital space, the newly rising tea brands choose to challenge the old giant directly in the area where Starbucks has long had an edge – the third space.

According to iimedia Media Consulting data, in 2018, the number of Chinese drinks stores exceeded 450000, and the scale of the new Chinese tea market was over 90 billion yuan. Among them, the new tea brands represented by HEYTEA(喜茶), Naixuecha(奈雪的茶), LELECHA(乐乐茶) and inWeTea(因味茶)upgraded their stores, entering shopping malls from the street stores, expanding the store area to one or two hundred square meters, which is similar to Starbucks in terms of store scale and directly competing with the latter for the “third space” of users.

At the same time, backed by investors, companies like Luckin are also expanding rapidly.

At the beginning of 2017, the total number of HEYTEA stores was about 50, which increased to 100 at the beginning of 2018 and to 180 at the beginning of 2019. Naixuecha is also catching up. It opened its first store in 2015 and grew to 178 by early 2019.

Although there is no public revenue data, Naixuecha once disclosed a set of figures in 2017 that the average revenue of its single store had exceeded 100000 yuan, and the annual revenue was about 600 million yuan. According to some public reports, the area-effectiveness of HEYTEA is even higher than that of Naixuecha.

By contrast, Starbucks has long recognized the importance of tea, but failed to make a breakthrough in the category for years. In 2012, after acquiring Teavana, Starbucks began a rapid wave of store openings.

However, the increasing number of chain stores failed to bring about the desired scale effect, and by the third quarter of 2012, the same-store turnover of Teavana had nearly stopped growing.

In 2016, Teavana came to China and became Starbucks’ high-end tea brand. Nevertheless, until now, there has been only two high profile ice shakers on the market — ice shaker peach green tea/oolong tea and ice shaker grapefruit honey tea. Now Teavana’s stores in China have no ambition to expand, and even began to close stores.

Unwilling to fail, Starbucks launched a counterattack on the tea market again at the end of April this year, by providing eight new products in the Chinese market.

However, these new-series-drinks including tea, coffee, and juice cocktails still did not satisfy Chinese consumers’ need. It seems that Starbucks has not yet found the right way to present a tea offering that appeals to the Chinese market. And faced with the challenge from local tea brands, they seem to offer no better solution.

Opportunities hidden in the blue ocean

Over the past year, while the domestic media has been describing a lot of stories about “Luckin vs. Starbucks”, some foreign media don’t think so.

Both CNN and Bloomberg believe that despite the fact that Luckin Coffee has enjoyed rapid expansion, compared with Starbucks, which has been in China for 20 years, it is still only a little guy.

They have their own reasons. According to Bloomberg data, while Luckin’s revenue in the first quarter of 2019 was $71.3 million, an increase of 3395% over the same period last year, on the other side, Starbucks has already had $703 million in revenue in China.

In other words, at least in terms of volume, the war between Luckin Coffee and Starbucks is more like an imaginative story than a grand showdown that many Chinese readers believe.

But when we go beyond the narrative of corporate competition and broaden our horizon to the entire Chinese coffee industry, some important information would be revealed.

According to the statistics provided by CBNData, China’s coffee consumption market is about 70 billion yuan, accounting for about 0.5% of the global market. The annual growth rate of coffee consumption in China is around 15%. It is estimated that the sales scale of coffee market in China will reach 300 billion yuan in 2020 and exceed one trillion yuan by 2025.

In addition, the current per capita consumption of coffee in China is only 0.03 kg, far lower than the EU’s 5.6 kg and the US’s 4.2 kg, and even below the global average of 1.25 kg.

Finally, from the perspective of coffee drinking structure, the proportion of fresh-brewed coffee in coffee sales in the world exceeds 87%, and the proportion of instant coffee is less than 13%. But in China, this is a quite different story: instant coffee dominates with a market share of 84%, while fresh-brewed coffee is only 16%.

It can be seen that China’s coffee market has huge potential for development, especially in the area of fresh coffee. Luckin or Starbucks, or some other tea brands? In a blue ocean, everything is unknown, and nothing is impossible.